--Please Select-- FORM CP37 FORM CP37A FORM CP37C FORM CP37D FORM CP37D1 FORM CP37E FORM CP37E Resident Non. The 2 withholding tax will be.

Details Of 2 Agent Commission Withholding Tax L Co

Ibu Pejabat Lembaga Hasil Dalam.

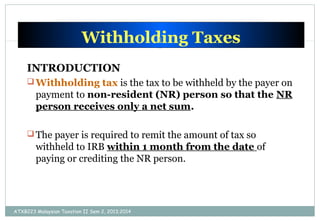

. Malaysian withholding tax applies to certain payments made or credited to non-Malaysian tax residents if the payments are derived from or deemed to be from Malaysia. Withholding tax is explained as an amount withheld by the payer ie. How to pay Withholding Tax in Malaysia and penalty if not paid.

Section 109 1 of the ITA requires withholding tax to be deducted from royalty payments derived from Malaysia and payable to a non-resident. 78 rows Any tax resident person who is liable to make certain specified types of payments to a non-resident is required to deduct withholding tax at a prescribed rate applicable to the gross. Example 1 Syarikat Maju Sdn Bhd a Malaysian company signed an agreement with Excel Ltd a non-resident company.

Withholding tax is an amount withheld by the party making payment payer on income earned by a non-resident payee and paid to the Inland Revenue Board of Malaysia IRB. 84 rows Payments made to non-residents in respect of the provision of any advice assistance or services performed in Malaysia and rental of movable properties are subject to a 10 WHT unless exempted under statutory provisions for purpose of granting. Malaysia is subject to withholding tax under section 109B of the ITA.

Foreign individualbody and paid to. Affected business modelsin-scope activities. Headquarters of Inland Revenue Board Of Malaysia.

Your company on income earned by a non-resident party ie. Download Form - Withholding Tax Category. The KPMG member firm in Malaysia prepared a monthly summary of tax developments PDF 32 MB that includes a discussion of the following income and indirect tax.

The general Withholding tax rate on royalties paid to non-residents in Malaysia is 10 and the corresponding Singapore rate is 10. The withholding tax is still applicable on the ADDs even though they are subject to tax instalment payments under instalment scheme CP500. Tax on Technical Fees Technical fees are payments of.

Withholding tax is an amount withheld by the resident carrying on business in Malaysia on income earned by a non-resident and paid to the Inland Revenue Board of. Up to 10 cash back Malaysia Withholding Tax and Treaties Online is a comprehensive online subscription service designed to help businesses manage this concern. Withholding tax is applicable on payments for certain types of income derived by non-residents.

The payer must within one. It is the only. The tax rate payable for.

Withholding tax is an amount withheld by the party making payment payer on income earned by a non-resident payee and paid to the Inland Revenue Board of Malaysia IRB. RM100000 01 RM10000. Withholding tax is an amount withheld by the party making payment payer on income earned by a non-resident payee and paid to the Inland Revenue Board of Malaysia.

Understanding Withholding Tax Microsoft Dynamics 365 Enterprise Edition Financial Management Third Edition

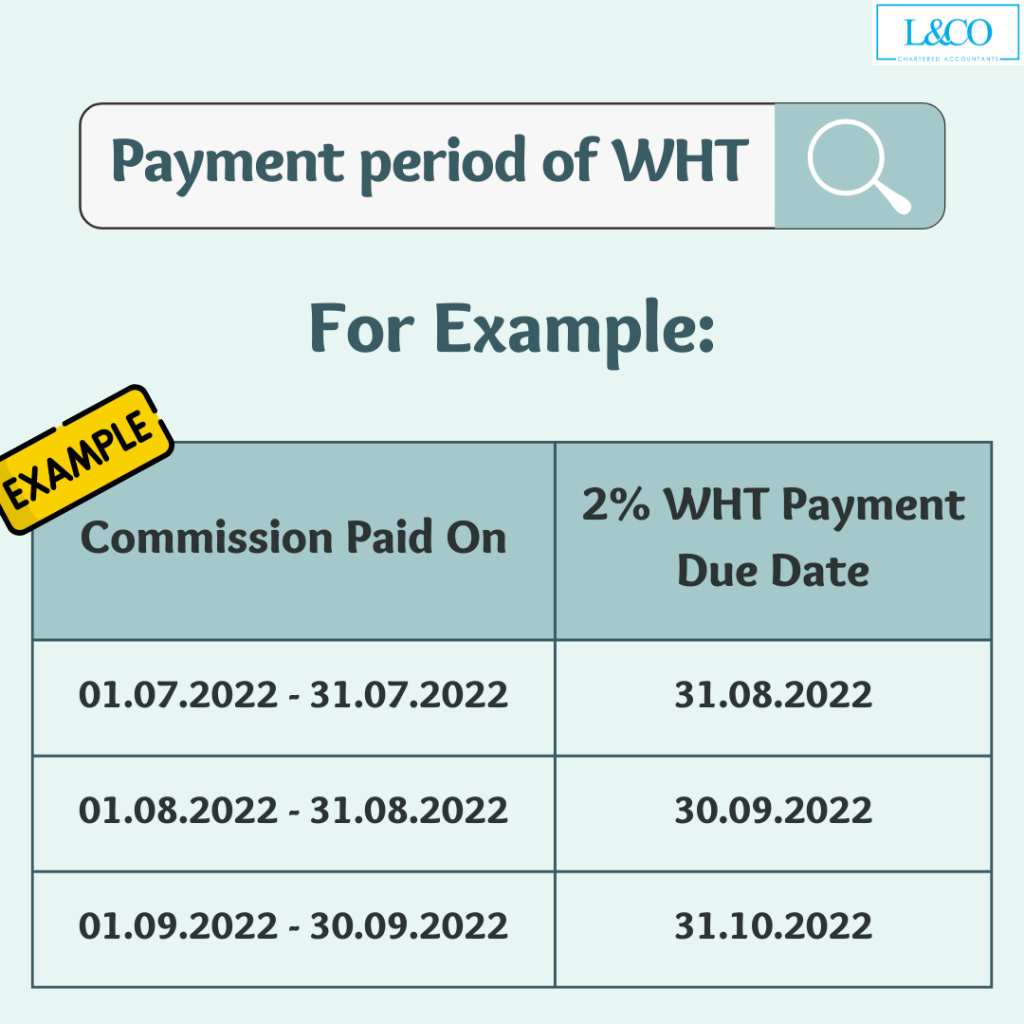

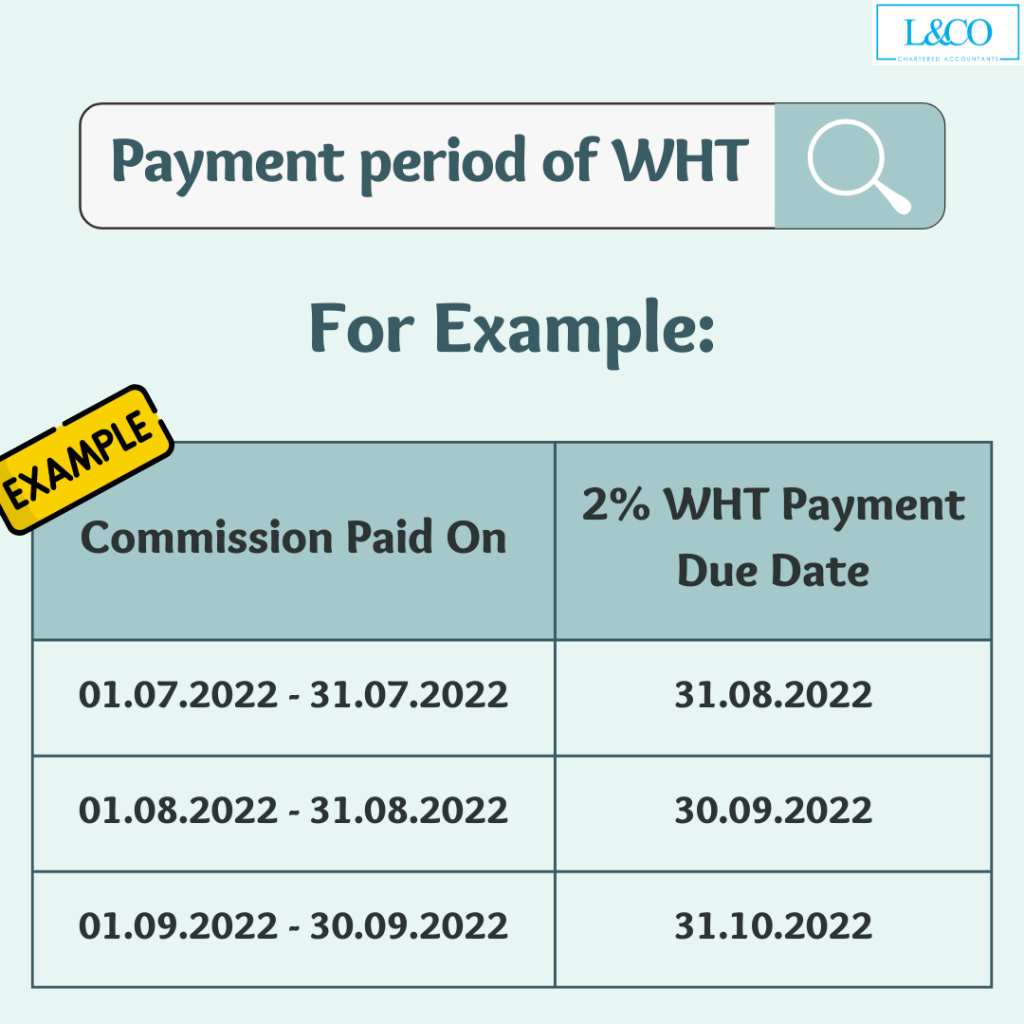

Details Of 2 Agent Commission Withholding Tax L Co

Preparing For Compliance With Withholding Tax On Payments Crowe Malaysia Plt

Notice Withholding Tax 10 Enagic Malaysia Sdn Bhd

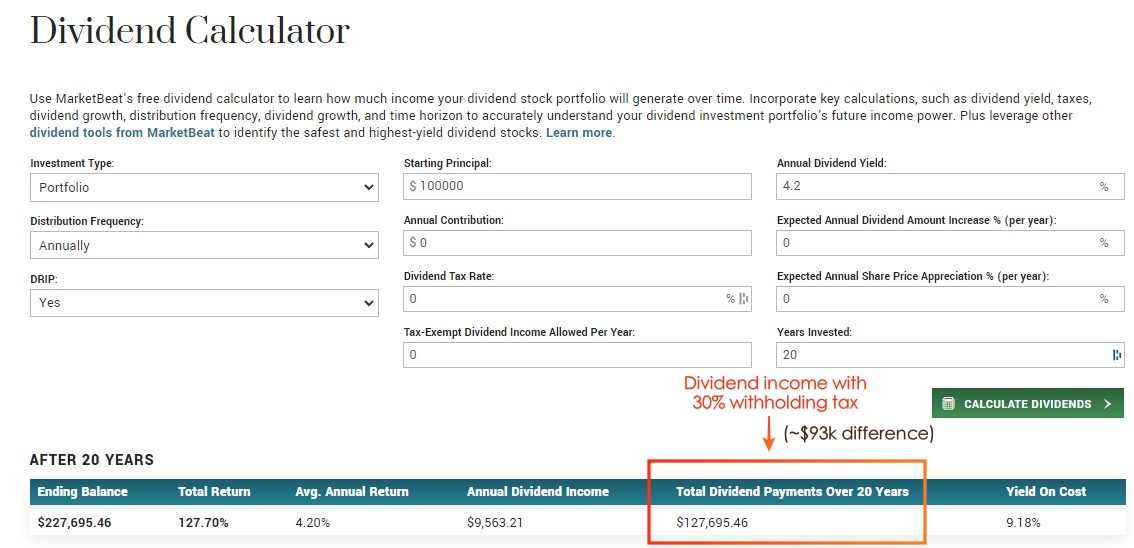

Sponsored All You Need To Know About Dividend Withholding Tax For Malaysians Stocks Etfs No Money Lah

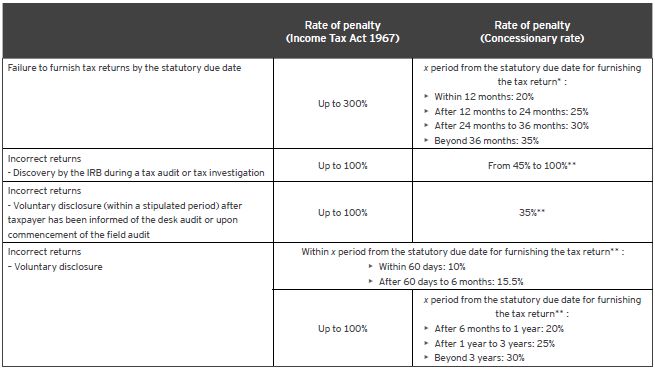

Tax Amnesty Waiver And Remission Of Tax Penalty Withholding Tax Malaysia

Bbva Bank Statement Template Mbcvirtual Statement Template Bank Statement Templates

Demystifying Malaysian Withholding Tax Re Run Kpmg Malaysia

Types Of Withholding Tax Malaysia Sap Simple Docs

Customizable And Printable Rent Receipt Templates To Help You Save Time When Creating Receipts Receipt Template Free Receipt Template Templates Printable Free

25 Great Pay Stub Paycheck Stub Templates Excel Templates Templates Payroll Template

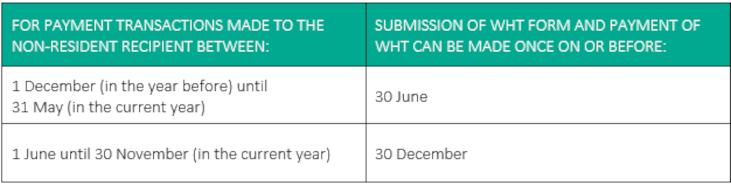

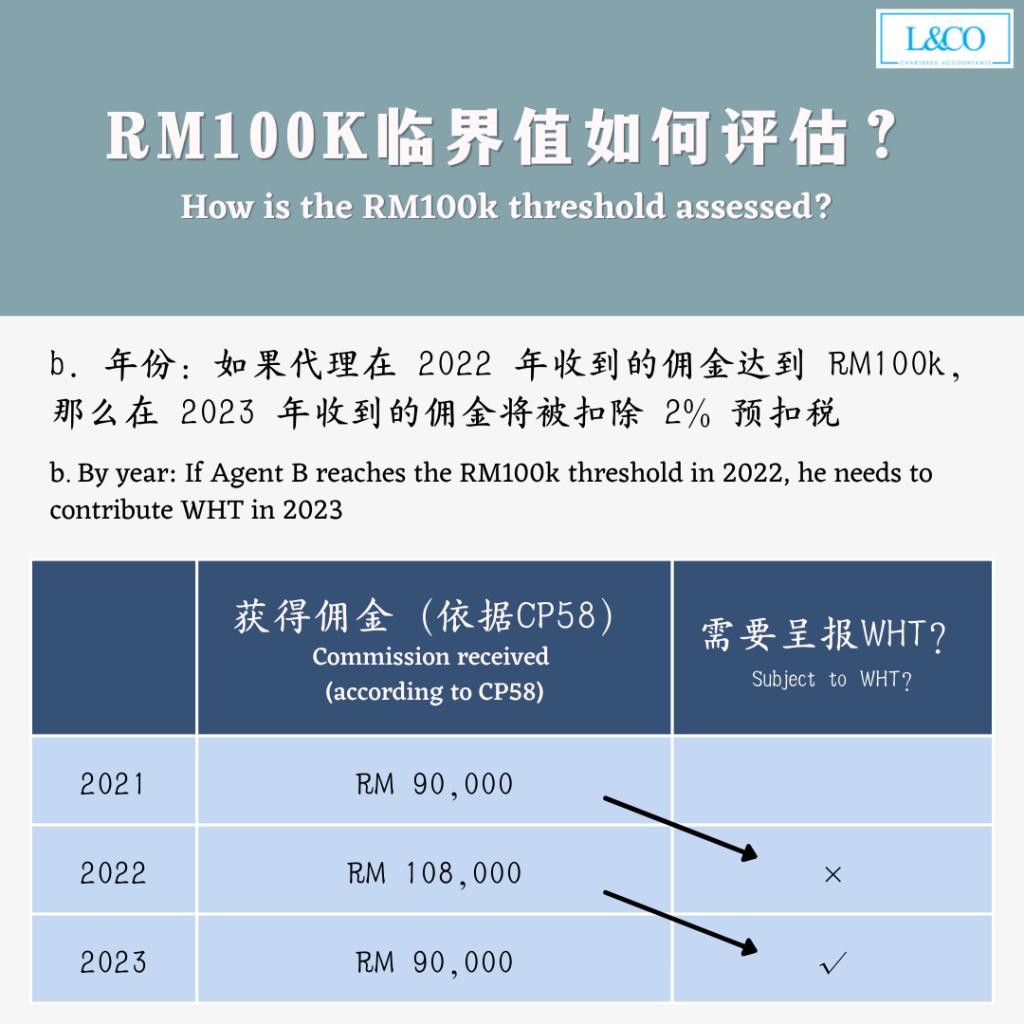

2 Wht On Payments Made To Agents Dealers Distributors Amendment To The Procedure For Operation

Irs Releases New 2018 Withholding Tables To Reflect Tax Law Changes

Types Of Withholding Tax Malaysia Sap Simple Docs

Details Of 2 Agent Commission Withholding Tax L Co

Payments That Are Subject To Withholding Tax Wt